What Is a KYC Application Form

A KYC application form is an online document that clients fill in so that investment advisors may gain vital information about the client, such as their risk tolerance, financial position, and investment knowledge.

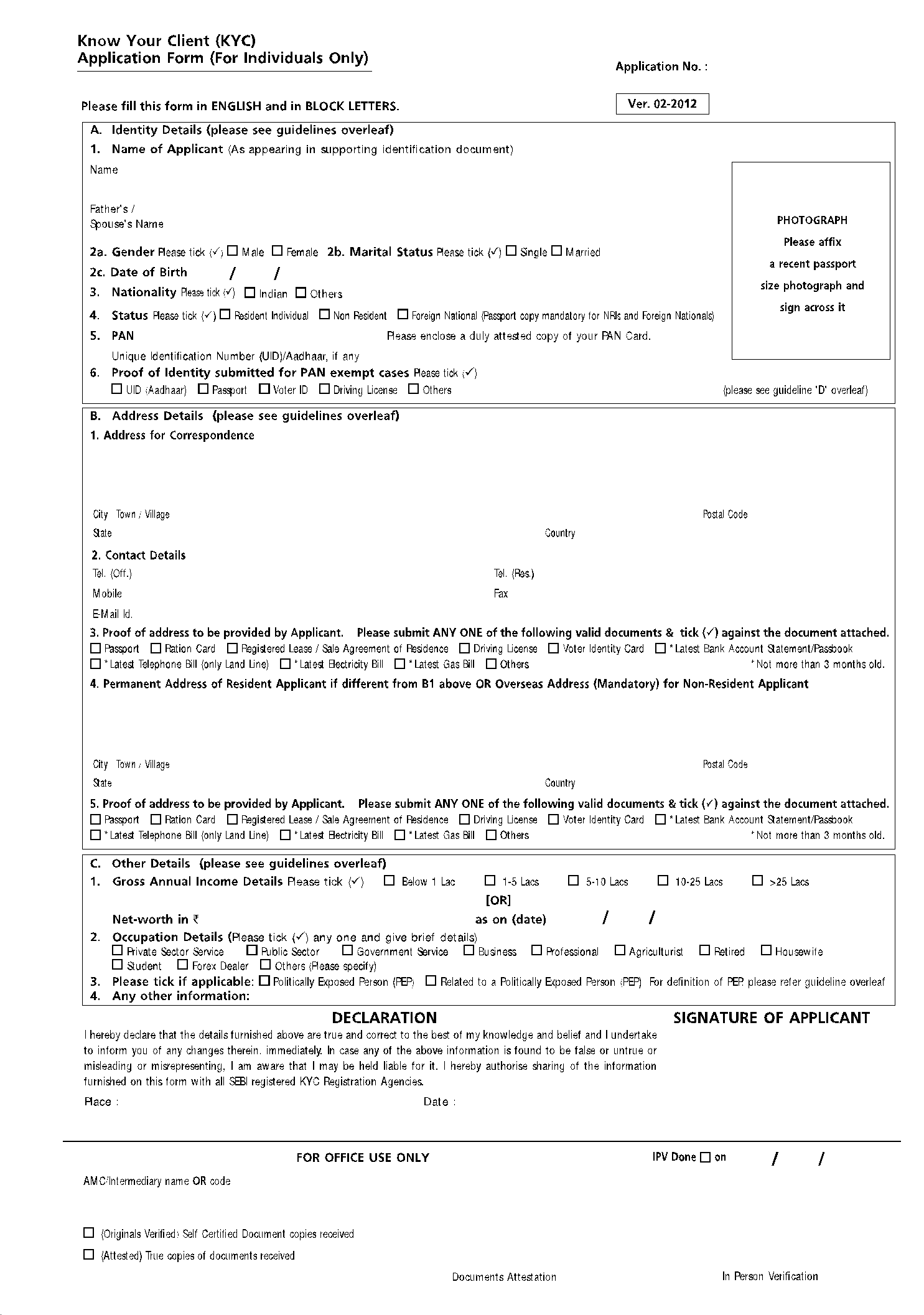

Information Required on a KYC Application Form

Before striking a deal with investors, you will have to provide the following information on your KYC application form:

- Identity details include name, gender, marital status, photos, age, nationality etc.

- Address and contact details

- Financial, occupational, political details, and any other important information.

- Declaration and signature

- Application number

How to Fill Out a KYC Application Form

Nowadays, clients require the KYC application form to safeguard their interests and investors’ advisors. This section will provide you with a guide on filling in the information needed through simple steps.

Step 1: Application Number

Once you have access to the KYC application form document on the top right corner, you will fill in the application number.

Step 2: Identification Details

After filling the first part, proceed to section A of the document, which requires you to fill in your identification details as you follow the guidelines. In this part, key in your name as it’s displayed on ID documents, father’s and or spouse’s name, gender, birth date, and nationality. This part will also require you to give your status PAN, unique Identification document, and proof of identity submitted for PAN exempt cases. In addition, you will attach a passport photo.

Step 3: Address and Contact Details

Section B requires you to provide your address details such as postal code, place, city, state, and country of residence in the first segment. You will also give out mobile and telephone numbers, email and fax addresses that you will accompany with an identification document as proof of residence, such as ID, voter’s card, or passport.

Furthermore, the section will require you to fill in the information regarding your permanent residency accompanied with valid documents like your driving license as proof.

Step 4: Financial Details

Section C will require you to bring forth financial information such as the gross annual income and net worth. Additionally, you will give your occupational information and political exposure in parts 2 and 3 by ticking on the provided boxes. The section also has space if you have any extra information that might be helpful.

Step 5: Declaration and Signature

The final step is to key your declaration details by inputting the place and date. Also, this is the section you will sign.

Step 6: Official

You’re not required to fill this section. It is for official purposes only.

What Is a KYC Application Form Used For

Security exchange institutions, financial services, and investment advisors use the KYC application form to verify their potential clients, evaluate partnership risks, and have a glance at the financial profile.

Who Needs to Fill Out a KYC Application Form

Usually, clients or business partners to a firm or legal business must fill out a KYC application form. Additionally, anyone planning on investing in the securities exchange industry needs to fill in the document.

Additional Resources on KYC Application Form

You can get more information about the KYC application form from these additional web pages:

- List of Approved KYC Rules | Internal Revenue Service (irs.gov)

- Your responsibilities under money laundering supervision - GOV.UK (www.gov.uk)

- 'Know your customer' guidance, accessible version - GOV.UK (www.gov.uk)